I’ll quickly summarize the impact of the TCJA (Tax Cuts and Jobs Act) that we’ve observed on personal taxes and then I’ll switch to the impact on small business owners by covering QBI (the Qualified Business Income) and changes to deductions.

The tax bracket has dropped significantly for personal federal taxes since the top rate is now 37% AND the higher tax brackets begin at much larger taxable income. Though this sounded like a great opportunity to reduce the family tax liability it was combined with drastic changes to the estimated tax deductions and elimination of exemptions. The net result for residents of high-income tax rate states (such as California) and who used Schedule A itemized deductions is that their taxes actually increased. Most others found no change or a small reduction in their tax liability in 2018 from the new rules EXCEPT for small business owners. We expect the same in 2019.

Small business owners have a unique new tool in the TCJA – the QBI deduction. This tool provides a real opportunity to reduce taxable income and therefore tax liability. The QBI deduction is available from 2018-2025 and is only for pass-through entities (businesses that are not C Corporations). This deduction is available without income restrictions for businesses that are deemed a ‘Qualified Business”.

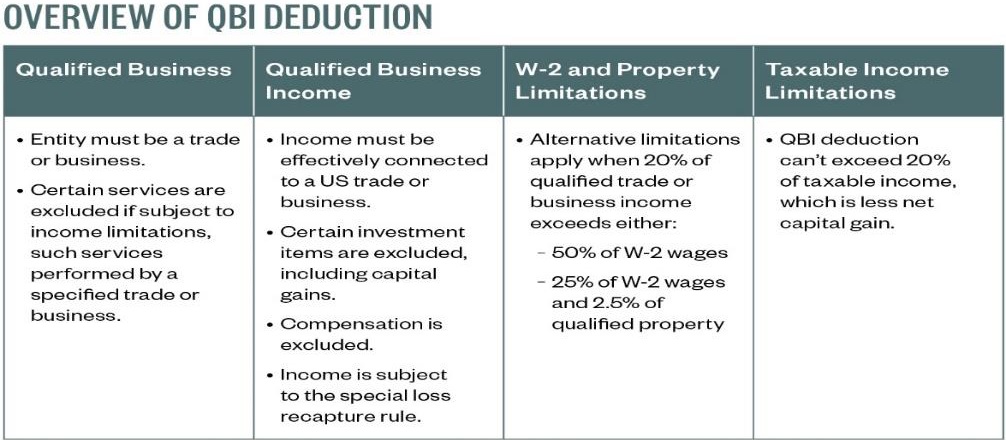

The chart above specifies that to qualify for this deduction you must be a Qualified Business. To be a Qualified Business it can’t be a service business or be a trade or business that involves the performance by the employer of services as an employee. The following are NOT a Qualified Business: doctors, lawyers, accountants, performers, athletes, health care professionals, financial and broker service providers, partnership interests. Only two service providing businesses are considered a Qualified Business: engineering and architectural firms. Though unclear in the code as to how gray areas would be decided the key catchall is that you can’t be a ‘Qualified Business’ if the business’ principal asset is the reputation or skill of one of the owners. Most of our clients own excluded (non-qualified) businesses.

As an excluded business owner (such as attorneys, consultants, etc.) you MAY STILL qualify for this QBI deduction IF your personal taxable income falls below the limits of $315K and $157.5K (married filing jointly and single filer respectively).

The QBI rule allows a Qualified Business (or excluded businesses that qualify under the taxable income limits) to reduce their taxable income by 20% of their QBI (QBI is business profit, not W2 income). An IMPORTANT CAVEAT is that the 20% deduction is the lesser of QBI or taxable income.

For example, if your business profit is $200K and your taxable income is $100K the actual deduction is $20K not the $40K that you might have expected. Regardless this new tool does provide for a way to reduce taxes.

When I initially reviewed the code, I was very excited for the Qualified Businesses owned by our clients since they were to benefit regardless of income. It was not until the last few months that a complicated wrinkle has limited this excitement. We’ve found that even Qualified Businesses have hurdles if the taxable income exceeds these same limits ($315K/$157.5K for married filing jointly and single filer respectively). If the business owner’s taxable income exceeds these income limits, then two additional rules are used rather than just receiving a deduction of 20% of QBI. For Qualified Businesses in excess of these limits there is a two-pronged test to measure the lesser of 20% of QBI (profit) OR the greater of either 50% of all W2 wages or W2 wages plus 2.5% of your qualified equipment/land costs. Yes, after jumping all of these hoops we found that some QB businesses didn’t qualify for 20% of QBI because the W2 weren’t high enough. Even so, the business owner did obtain a deduction though not as high as was initially estimated.

Added to the QBI deduction the TCJA rules also include these changes:

1. Entertaining clients is no longer a business expense that is deductible federally (it used to be 50% deductible). Office parties are still 100% deductible.

2. Businesses supported by debt financing can only deduct 30% of the owner’s adjustable taxable income BUT don’t despair since it will only apply to small businesses that have gross receipts of $25M for each of the last three years.

3. NOL deduction (Net Operating Loss) which is often carried back two tax years or future 20 years will now be only allowed for years going forward AND limited to 80% of income in that year.

I’m providing this education article to give perspective on how you benefit from the TCJA tax rules. Our ultimate goal is to have you knowledgeable enough to understand the critical role of taxes in your planning. If you have additional questions feel free to ask us or your tax preparer.

Edi Alvarez, CFP®

BS, BEd, MS