I am sometimes asked how our work differs as clients move from a period in which they are accumulating assets (pre-retirement savings) to a period in which they withdraw/distribute from their assets (retirement or financial independence). This becomes a critical question as individuals transition out of earning years and begin to implement their retirement plan. As a matter of fact, our tasks are very different in each case though our role remains the same. Our role is to provide financial guidance to help make the most of available assets given current realities and future goals. To help you understand the various financial tasks that occur in these two distinct financial planning periods, I’ve outlined some of the major tasks that we perform in pre-retirement (accumulation phase) and in retirement (distribution phase). During the accumulation period, our focus is to encourage you to integrate finances with all major decisions. We work with you to save as much as possible using tools or techniques that we know will likely be successful in your situation and come up with ways that work better for you. We also support you to define spending that is meaningful because we want spending to be sustainable and satisfying later in life. Annually, we help set spending and savings goals and ask you to hold yourself accountable because with accountability comes financial self-confidence. We also want you to experience the ups and downs of portfolio behavior over a significant period so that overtime you will learn to relinquish unproductive human emotions that are associated with daily monitoring and fretting over your portfolio total (which feeds fear and greed). We want you to internalize that what really matters is that the portfolio delivers as expected to meet your goals. It is therefore important that during accumulation (when you are not dependent on the portfolio), you can confirm that the returns used to create your financial plan are attainable by the average return of your own portfolio (not a model or generic return). Overall, we want you to identify how you can best work with finances and gain confidence in your own ability to make financial decisions regardless of the obstacles. During retirement we are more involved with your cash flow management as we help you transition to financial independence by implementing your financial plan. This requires providing the needed cash flow from your accumulated portfolio. In retirement we annually setup monthly cash-flow distributions (or an annual lump sum distribution) from the portfolio and we internally estimate the tax liability so that we have the best after tax result for each distribution. We find that tax planning also helps prevent unexpected increases in future Medicare premiums, helps make Roth conversion decisions, and helps decide on the best timing for Social Security benefits. RMD (Required Minimum Distributions which begin at age 72) are also calculated and implemented based on what is best for your overall finances. We may recommend QCD (Qualified Charitable Distributions, only for those at age 70.5) or DAF (Donor Advised Funds which are available to anyone who wants to make significant or regular charitable donations) in some cases. Finally, we serve as your financial resource or partner to support you during major financial decisions. Let us know if you have different questions or want more details on what is currently most important in your life, regardless of whether you are in pre-retirement or already enjoying your well-earned financial independence. Edi Alvarez, CFP® |

Monthly Archives: January 2022

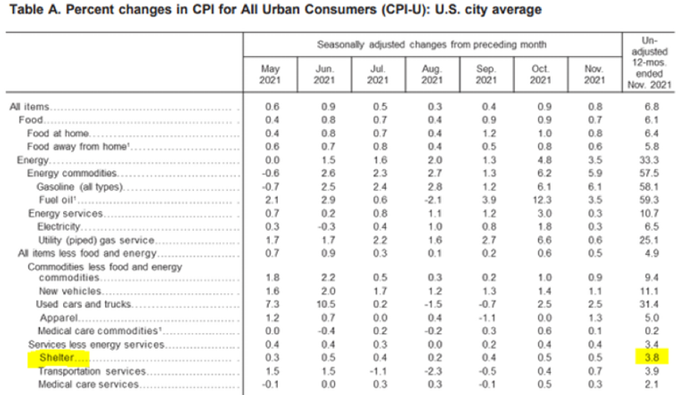

Inflation Expectations as of January

On Tuesday, January 11, 2022, Federal Reserve Chairman Jerome Powell called high inflation a “severe threat” to a full economic recovery and that the central bank was preparing to raise interest rates because the economy no longer needed emergency support. Powell further stated that he was optimistic that supply-chain bottlenecks would ease this year and help bring down inflation while the central bank begins removing the emergency support we’ve depended on for years. The January inflation rate (CPI) is reported at 6.1%. With U.S. debt approaching $30 trillion and growing at $2 trillion per year The Fed is in a tough spot, they must find ways to fight off inflation. Debt is often a drag on future growth unless the debt is used to increase GDP and stimulate the economy. With higher interest rates and without additional economic growth (GDP), the U.S. government will struggle to cover interest payments given that tax revenues are at about $1 trillion per year. So, I expect aggressive measures will be taken to check inflation.To be honest, there is little agreement on the likelihood that 2022 inflation will be permanent. Some believe that the current wave of inflation will prove to be transitory and expect, at worse, a slowing of the global economy in the first half of 2022. Others argue inflation is not temporary and will be devastating through 2023 (they usually use the 1970’s period as a painful reminder of extreme inflation). I am cautiously optimistic and believe that in the long-term what matters is our ability to increase economic growth. I also believe that consumers have a lot more influence over inflation than they realize – inflation is not magical or something to be afraid of but rather a reaction to something we consumers encourage or discourage with our behavior. Every time we purchase something despite its excessive price, or we raise the price despite the actual cost, we contribute to inflation. Consumers can practice restraint over consumer discretionary purchases, but it becomes much more challenging when inflation impacts the essentials or basic spending. For example, if your rent increases at 4% (see the chart below), this is not optional so something else needs to be reduced or your income must increase thus fueling inflation.  In your portfolio we are continually monitoring and adjusting for expected inflationary pressures, volatility, and increased interest rates. Our belief is that with infrastructure funding we’ll reach a high GDP by year-end and a good portfolio outcome. Without economic stimulus we are likely to have a more volatile and less predictable performance this year. You may notice that we added tilts to the portfolio that increased commodities (primarily cereals, materials, energy) and digital/tech assets (like digital supply chain, traditional finance, and fin tech companies) which we expect to do better during inflationary periods. Fixed income is tilted to the short-term and should provide stability if the expected volatility in equity markets materializes. Edi Alvarez, CFP® |

Student Government Loan Repayments to Restart in May

The Department of Education has announced that it will restart student loan payments that were frozen at the start of the pandemic. This was intended to allow for increased cash flow and savings during the pandemic. So far, it does NOT appear that the government will create new student loan forgiveness programs. If you were able to save over the last two years, then let’s review if paying down your student loans is the best use of your additional savings. Action for those with a federal government student loan:

Finally, when working online to obtain information on your student loans (or other financial transactions) please err on the side of caution and check with us and your CPA to ensure that you avoid scammers. They get more sophisticated each day. Edi Alvarez, CFP®BS, BEd, MS |