If you are a small business owner, you’re probably familiar with the term “sweat equity.” Essentially, sweat equity is a measure of the added interest or increased value that you’ve created in your business through plain hard work (that is to say, through physical labor and intellectual effort). Typically, business owners just starting out don’t have the necessary capital or don’t want to hire a large staff to run the business or to purchase high-tech, so they put in untold extra hours, do much of the work themselves and try to “think smart” in terms of marketing or production. They often use this opportunity to develop a clientele and a business process they enjoy. If well designed it can be profitable, but at some point the owner must put in place strategies that can convert business profit into personal wealth.

In other words, to be considered a truly viable business, at least two things must happen (there are others, but for the purposes of this article we’ll just focus on two). One, you must evolve the business to the point where it is sustainable with only the amount of personal labor you want to dedicate and in a way that allows you to maximally build Owner Wealth while covering business cash flow needs. Moreover, the goal is a process that gives you a sense of accomplishment and satisfaction. This is what we call a “life-style” business. Or two, you must organize and prepare the business to a degree or footing that it can be sold for a profit, at least enough and in a manner that will allow you to retain the profit as personal or “Owner Wealth.”

I should note, for those who are not self-employed, that employees can also generate sweat equity for their firm by creating additional ways to increase the bottom line. For startups, you may defer your vacation and even put off earnings. All these things add value to the company, but employees will expect to receive some form of compensation either in the form of existing benefits (bonus, parental leave, or nonqualified plans) or in shares of company value.

As a business owner, the first question you must ask yourself is “What do I want my life to look like while I’m creating this equity, and what do I want to accomplish in the long term?” Once you answer this question, and only then, can we come up with a proper plan to support your direction.

It is our experience that business owners without such a plan likely encounter challenges that can undermine their ability to convert their equity to personal wealth. These challenges come either in terms of selling the business or ensuring that the life-style business is sustainable. For instance, there is a good chance that instead of generating wealth to your maximum potential, you’ll be funding Uncle Sam (and the California Franchise Tax Board) and coping with cash flow problems.

Presupposing your business is already generating profits, a well-tailored plan can (at least potentially) make a big difference in terms of retaining or accumulating Owner Wealth. Aside from using earnings to support current lifestyle, your business can create benefits that permit the owner to retain earnings for future use and reduce current tax liability, particularly important in California, where the tax liability on business owners with profitable business can exceed 50% of their business profit.

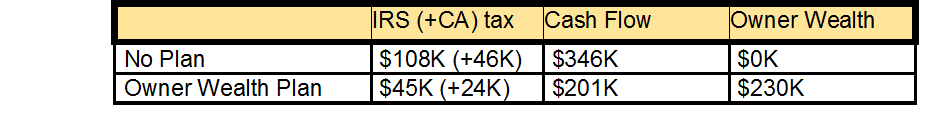

For example, a business owner with sweat equity from their start-up or life-style business that yields around $500K per year (after business expenses) might have a tax liability of $110K (IRS only) or $155K in California (see table below). Using available benefit tools/strategy an owner can (in this scenario) build wealth annually of about $230K. Much of their wealth is built from deferring taxable income and lowering their tax liability to $45K (or $70K within California).

Allowed to grow over 5, 10, or 20 years this strategy could (at a conservative 5% annual return) yield wealth of $1.3M, $2.9M and $7M respectively for the business owner. On its own, tax and benefit planning can yield a high conversion of sweat equity to Owner Wealth.

When starting a business, the last thing we ever think about is how we’ll exit from it and collect on all the hard-earned sweat equity we’ve invested. We’re usually focused on creating value and determining how we can generate sufficient earnings. Yet for some businesses it is only from a well-designed and planned sale that the owner will realize any personal wealth from their risk and hard work. For the owner of a life-style business, selling your firm may seem akin to selling off your first-born, but there comes a time in all our lives when such decisions are unavoidable, even advantageous. At the very least, it may be worth considering selling part interest in the business as a way of reducing workload and simultaneously augmenting Owner Wealth.

As an owner ready to sell you will want to be confident that you are choosing the right time, securing the best price, and structuring the transaction wisely. You’d be well advised to seek expertise in selling your business (particularly new entrepreneurs), and give plenty of thought to how it will impact Owner Wealth, which is all too often overlooked.

When considering how to exit from their business, entrepreneurs need to at least follow these 7 steps to maximize Owner Wealth.

- Plan your exit well in advance since the best fit team and solution may take time to identify and develop.

- Understand and acknowledge your emotional connection to the business. It can be deeply personal and leave you unsatisfied if not fully addressed – regardless of profit.

- Prepare the business for the sale so that it is financially attractive to the financial advisors of potential buyers.

- Choose experienced individuals in your specific type of business to guide you through the process of selling your business BUT include your personal advisor to ensure that the best exit also meets with your personal financial goals. Again, building a team that is right for you.

- Think clearly about family succession – don’t make assumptions on how your family or key employees feel about the business.

- Gauge the interest for a friendly buyer from co-owners, family, employees, vendors, and even customers.

- Develop a thorough wealth strategy plan. The wealth strategy plan should NOT be just about the business but should address how your efforts will be used to build your personal wealth and meet your personal goals.

Take the time to know yourself, know your goals and make absolutely sure your financial advisor has a clear picture of your objectives. Together, your plan will convert all that valuable sweat equity into wealth to fuel your dreams.

Edi Alvarez, CFP®

BS, BEd, MS

www.aikapa.com