Be the First to Understand and Care about Company Equity

by Edi Alvarez, MSc, CFP®

Employers

establish company equity plans to foster a connection between your work and the

success of the company. These plans may provide you with access to equity

through stock purchases or an opportunity to purchase equity at a future date

through stock options. Ideally, company equity will grow throughout your tenure.

The thought is that this opportunity entices talent to the firm, keeps costs

down, and motivates, retains, and inspires employees. Even so, individuals don’t

participate in company equity plans and even in favorable markets let stock

options expire. Why?

Employers

establish company equity plans to foster a connection between your work and the

success of the company. These plans may provide you with access to equity

through stock purchases or an opportunity to purchase equity at a future date

through stock options. Ideally, company equity will grow throughout your tenure.

The thought is that this opportunity entices talent to the firm, keeps costs

down, and motivates, retains, and inspires employees. Even so, individuals don’t

participate in company equity plans and even in favorable markets let stock

options expire. Why?

The reasons for nonparticipation include: “No time to deal with

it,” “don’t understand the value,” and “judged the market risk too high compared

to potential return.” In the Bay Area, some AWIS members had this to say about

company equity: “Company equity? Yeah, HR rattled off a bunch of acronyms the

day I started”; “I know one of them is vesting soon, but I haven’t really had

time to look into it”; “I decided not to participate because I don’t have the

money. Besides, I’m already maximizing my 401(k). That’s plenty and a lot safer.

I mean, company equity is just a way to keep my salary low, right? Why should I

participate?”

Sound familiar? I was pleased to find that some of you are “old

hands” at company equity plans, but some answers convinced me that I should

start with a refresher.

Company equity plans are a way for employees to access company

shares even while the company is privately owned. Some plans are available only

to upper level or key employees, while others are available to all employees.

Stock option plans, once granted, give the qualifying employee the right to buy

the firm’s stock after a set period of time (the vesting period) and for a fixed

amount of time before they expire.

AWIS members interviewed participate in

different company equity plans, including Incentive Stock Options (ISO),

Non-Qualified Stock Options (NQSO), and the Employee Stock Purchase Plan (ESPP).

Some have been awarded Restricted Stock Units (RSU), which are commonly offered

by large multinational companies and are becoming more popular. Several

individuals interviewed benefited from restricted stock awards, which are a form

of compensation for owners and upper-echelon personnel. The only commonly used

equity plan that was not mentioned was the ESOP (Employee Stock Ownership Plan),

which works like a 401(k) plan but invests in company stock. As mentioned,

employers offer these plans to motivate employees through the power of

ownership, yet many respondents intimated that their main reasons for remaining

at a particular company was earning a good salary with other nonequity benefits. Others cited less tangible reasons such

as the freedom to direct their own workload or the value in the intellectual

challenge. Despite these nonfinancial reasons, as we

look for ways to support our personal goals we invariably lean toward firms that

help us build a solid financial future while providing for professional growth.

Company equity purchase plans can be an important part of that equation. For

some, company equity has already provided the key to financial independence.

Where to start? Here are four important steps to consider:

1.

Become familiar with the available equity

plans. I’ll briefly review the three most commonly mentioned plans: ISO, NQSO,

and ESPP (I’ll save for another discussion ESOP, RSU, and phantom stock plans).

The first two are stock options, which carry the most flexibility, and the third

allows for monthly purchase of company shares at a discount. Stock-option plans

give you the right to purchase stock at a price some time in the future (when

they vest). The vesting time is set by the company (usually 2-5 years), at which

point you have the right to exercise your options and purchase shares. Along

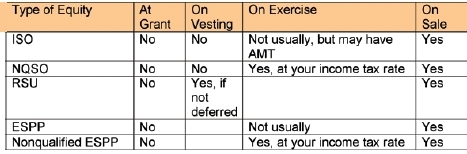

with knowing about market risk, you need to be aware of tax consequences (see

table on tax comparison). The plans’ tax consequences are highlighted in the

table below.

·

ISO

have very strict rules on when you can exercise them and who can own them. If

you work within the rules, they have favorable tax consequences but can trigger

Alternative Minimum Tax (AMT). Also, holding the stock prior to sale for at

least one year after purchase and two from the grant date results in a lower tax

rate but does expose you to market and company risk.

·

NQSO

have less restrictive rules and can be awarded to non-employees, like

consultants. Because they do not qualify for preferred tax treatment, they have

two tax points. One occurs when you exercise the option,

and the other when you sell it. Notice that you don’t need to sell to assume tax

liabilities.

·

ESPP

is an excellent way to slowly grow your savings while working at an established

publicly traded firm. Though these plans differ, I have encountered many that

allow employees to contribute after-tax income during an offering period. At the

end of the offer period, stock is often purchased at a discount (5-15%). Many

will also offer a “look-back” provision that uses a lower earlier price. Another

advantage of qualified ESPP is that tax liability exists only after they are

sold. Sometimes a good strategy is to sell your stock immediately and collect

the aftertax profit; however, many plans will not

allow immediate sale.

2.

Read the plan document and identify the

important components. Options are a great way to control the recognition of

taxable income and market risk because you do not own the stock until you

exercise the option. To do this, you must know how your individual plan works.

How will your equity change if there is a liquidity event or corporate

restructure? What are the rules on when you can or can’t use this equity?

When reading your

stock-option agreement, I encourage you to record at least the following

information: What type is it? What is the vesting schedule? How will the price

be set? When will they expire? What are the restrictions and limitations to

buying/ selling your stock? Will they automatically withhold taxes? And if so, at what rate? What happens when your job ends? How

will your options change if your company changes ownership?

You will want to

know at least the following information about your company’s ESPP: What discount

will you receive? How is the price set? Does it have look-back? When is the

offer period? How and when can you reverse the purchase? What are the selling

rules (can you sell on the same day as you buy the stock)? And, are there any

restrictions and limitations? What will happen if there is a corporate

restructure? What happens if your job ends?

3.

Be clear about your goals. Know the

reasons for investing in company equity. The purpose is to ensure that your

emotions don’t lead you into costly mistakes.

4.

Establish a schedule and identify your

triggers. If your goal is to spend the proceeds of each sale for a specific

purpose, that amount has an impact on the “trigger” to exercise and sell. You

can easily set the stock price that will be your trigger if your spending goal

is clear. Depending on your situation, you may play it safe and exercise and

sell at the same time. An alternative is to exercise and hold the stock long

term. This is often intended to lower taxes or to meet a vesting requirement.

Remember, the moment you choose to hold onto company stock, you are making a

decision to carry company risk – make certain this fits with your goals. In some

cases, it is ideal to exercise as late as possible and immediately sell. Others

will be required to exercise options on a regular schedule.

In summary, if your plan

allows, hold the option but not the stock, at least until you are ready to use

the profits or if the options are close to expiry. This strategy works well but

carries higher tax consequences and needs to fit in your overall financial

plan. ESPP provides a slow and steady saving opportunity as long as company

stock is not overvalued. If your company’s ESPP has reasonable provisions, then

consider participating, but always set your triggers and have an exit plan.

But what about your 401(k) plan? How do “stock option”

plans dovetail, if at all, with retirement saving plans? If your employer

provides a match to your 401(k) plan, then you should be contributing enough

each year to earn the entire employer match. Beyond the portion that is

guaranteed to receive a match, your next best investment is dependent on your

specific situation. So ask yourself: How close are you to retirement? How well

does your 401(k) perform compared to your company stock? Is your company

currently undervalued? These are important considerations that are specific to

you. In some cases, equity plans are a better way to reach your goals, but at

other times the tax-deferred earnings inside a low-cost retirement plan may

provide the best opportunity. Have someone guide you or spend the time to

understand how company equity fits into your financial plan. In the final

analysis, your company equity plan can help support your core financial goals,

force you to save, and provide an opportunity to invest in and get to know your

company. It should be a part of how you evaluate existing and new employment

opportunities.

Remember, finances are a very individual matter. My suggestions are

intended only as a guide to understanding. They may not be appropriate for your

specific situation. Thanks to everyone who so generously answered my questions

and shared their experiences. You helped transform this column from one

outlining the technical aspects of options to one that deals with company

equity. Your continued feedback helps to make the Money Matters column relevant.

[Originally published in AWIS Magazine, Winter

2010.]

© 2010 Edi Alvarez. All rights reserved.