Financial Planning Considerations for Women Scientists

by Edi Alvarez, MSc, CFP®

In this

edition, I will explore a few areas of importance to scientists, particularly

women scientists, and the value of planning for a healthy financial future.

In this

edition, I will explore a few areas of importance to scientists, particularly

women scientists, and the value of planning for a healthy financial future.

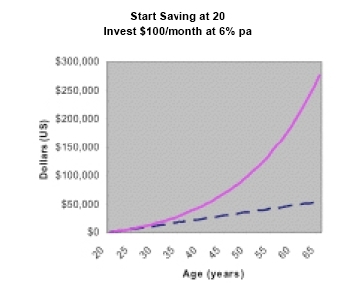

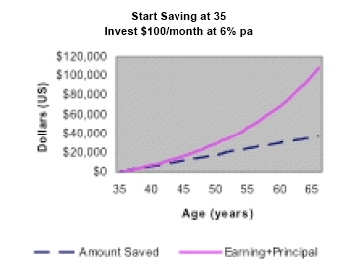

First and foremost, we should acknowledge that as scientists

we take longer to reach our full earning potential. The amount of education

required to become a Scientist (which can include undergrad, graduate and one or

several post-doctoral studies) consumes a large amount of our early earning

years. If at 20 you started saving or instead waited until the end of a couple

of post-docs – what impact do you think this would have on your finances at 65

(assume 6% interest)? Although the amount you save is important as is the

interest rate, time has a compounding impact on your investments.

These charts are meant only to remind us that late entry into the

formal workforce leaves us with less time to catch-up on our long term financial

goals. In addition, we will enter the workforce during a financially demanding

phase of our lives when we are both developing our careers and our families.

Scientific endeavors can also be inherently risky. Our lab work

exposes many of us to unknown risks. When we graduate our greatest asset is our

knowledge, creativity and our ability to learn and digest information. Without

realizing it, we may be exposing this most valuable asset to risk. To properly

manage risks at different stages of our lives we need a clear understanding of

our current finances, our family needs and our future goals.

Statistically, women are still shown to outlive men and must plan

for a longer work or retirement life. Moreover, in our society women often take

on the role of caretakers – caring and planning for their kids, elderly parents

and their own future. As scientists we can use financial plans to coordinate all

of our resources to meet life challenges on our own terms. Not planning will

leave women disconnected and at the mercy of the changing realities with

parental care, home costs, education costs, investment market changes, career

consequences, relationship changes, health issues and meaning of life issues.

Throughout my

career I seldom worked 9 to 5 – you might be the same?! I was in and out of the

lab at all kinds of hours. And when not in the lab, I was striving to keep up

with the most recent articles or planning for the next phase of my life. Later,

I spent long hours working through business and government systems to accomplish

my career and personal goals. During this time our finances should be working in

parallel so we have the buffer to live life on our terms.

Often we delay, putting off critical financial decisions until we

can find enough time to research all the possible avenues, study them thoroughly,

and make a balanced well-reasoned decision. The devil is in the details, after

all. Our analytical approach can lead us to seek a lot of data and explanations

before we feel confident enough to commit to a particular financial course of

action. Scientists can be first-class over-thinkers – unable to see the forest

for the trees! Then we wonder how others who work 9-5 can retire at age 55, put

two kids through college and travel to Italy every summer with such apparent financial

ease and nowhere near our education. Our financial resources need to be harnessed

and shaped early, just like our education so that it can grow as we grow our

careers. It is never too early to take stock of finances, review our goals and

align the two.

Moreover, as scientists we are fortunate in that we are exposed to

many investment and earning opportunities: 401K, stock plan, employee plan,

alternative investment, new venture and venture capital. Matching these

opportunities with our life goals will enrich our financial life and add flexibility

to our personal and professional life.

Our career

choices are many and each has implications. It is to our advantage that we

understand the math and the logic behind complicated risk and investment

decisions. Understanding those implications combined with a pro-active and

informed approach on investment and financial issues can best help us reach our

goals. As women scientists, our greatest asset is that we are intelligent, well

educated, life-long learners – let’s align our

financial health with our career and life goals so that we can reach our maximum

potential in our chosen lives. Since we often also contribute to our community’s

well-being, planning early and clearly for our family’s financial future will

allow us to meet our personal, professional and philanthropic dreams.

[Originally published in sfAWIS Newsletter, vol 4, no 3,

Summer 2007.]

© 2007 Edi Alvarez. All rights reserved.

www.aikapa.com

In this

edition, I will explore a few areas of importance to scientists, particularly

women scientists, and the value of planning for a healthy financial future.

In this

edition, I will explore a few areas of importance to scientists, particularly

women scientists, and the value of planning for a healthy financial future.