People often talk about “saving for retirement.” Few question the need to put aside adequate savings to ensure the successful funding of their retirement plan. The operative word though is “adequate.” How much in the way of savings is “adequate”? Of course, it differs from individual to individual, but you will most likely find that spending is the common variable that shapes the limits of what constitutes adequate savings. With few exceptions, our spending needs in retirement will exceed the amount provided by our inflation adjusted social security benefit. Everything else being equal, the success or failure of any effort to fund retirement is above all dependent on lifestyle and spending habits or ‘burn rate’.

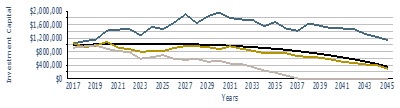

To help you visualize “the power of spending” and its impact on a retirement portfolio, I’ve created four basic retirement funding scenarios. These scenarios assume the same retirement period (beginning 2017 and ending 28 years later), an annual social security benefit of $40K (adjusted for inflation), and a $1M diversified portfolio with a rate of return of 5.5%. The only varying parameter between scenarios is the amount of spending each year with associated tax liability. Each scenario was created using 500 cycles of Monte Carlo probability simulations that modify every parameter except length of retirement to address a range of economic variables and unexpected expenses. The charts include only four (out of 500) projection lines from “best case” to “worst case”.

For the first scenario, our hypothetical client spends $50K/year (before tax), having accumulated $1M at the point that she is ready to retire in 2017. As the chart demonstrates, for the best possible outcome the $50K annual spending client actually grows her nest egg to $1.4M over 28 years (this is the blue line or highest line at year 2045) ― leaving, I should add, a sizable chunk of change for a life beyond 28 years, long term care needs, or for her legacy (be it a favorite charity or her grandchildren). If all economic variables are worse than expected and things don’t quite pan out, she can still expect $250K in assets (see the gray line or lowest line at 2045) after enjoying 28 years in retirement. Not too shabby!

But what if our hypothetical client was in the habit of spending about $75K/year (before tax) instead of $50K? (again, assuming she starts her retirement in 2017 with a $1M portfolio). In this situation, assuming everything goes better than expected the Monte Carlo simulations show a surplus of over $1M after 28 years, BUT in a worst-case scenario the portfolio is depleted after 20 years (around 2037) ― enough to make a financial planner seek ways to protect against the worst-case scenario.

Approaching the Bay Area experience is a hypothetical client who spends $100K/year (before tax). What then? The $1M portfolio would not last her beyond 21 years (2038) even in the best scenario. Unfortunately, there is a higher probability that it will be gone after 15 years (2031). While the worst-case simulation shows that the portfolio could be depleted in as little as 10 or 11 years (2028).

Though there are many other possible spending targets (and also more parameters to consider than those in these scenarios), our final hypothetical client spends $150K/year (before tax) to maintain her lifestyle. In which case, the $1M portfolio would last 9 years tops (2026) and could well be depleted within 5 years (2022).

The story told by the 4 charts is very clear. Saving and spending levels must be aligned for a successful retirement strategy. Clearly, accumulated assets alone are not in and of themselves indicative of success over the long-haul. On the other hand, spending habits and your ability to adhere to a budget are very useful indicators. They can provide a realistic view of your retirement “burn rate” and better align your savings today with future need.

Think of it this way, your approach to spending and your connection to buying are formed throughout your life. It becomes an unshakable habit. For this reason, spending seldom decreases in retirement except with a great deal of stress, anxiety, and depression. To avoid this unhappy outcome, the smartest and healthiest action is to establish a realistic budget for the lifestyle that you seek, then plan your savings around the cost to sustain that lifestyle. The goal of your retirement savings would be to build enough wealth to support your lifestyle.

Though planning for retirement includes more than your burn rate and savings rate they are critical beginnings. What I like best is that these are aspects of retirement planning that we can control.

Edi Alvarez, CFP®

BS, BEd, MS